Rising Home Values Are Driving Property Taxes Higher—These States Are Trying to Do Something About It

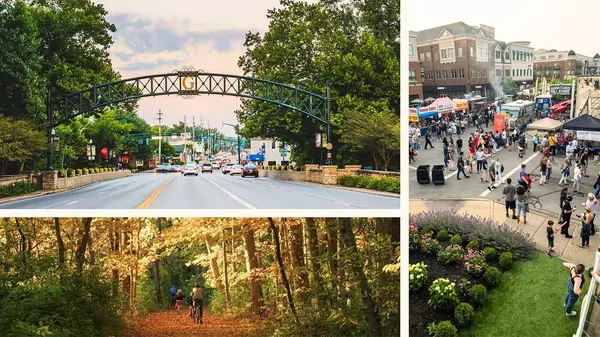

Realtor.com; Getty Images

Soaring home values are a boon to homeowners who’ve seen their equity climbing. But they can also bring a nasty surprise in the form of rising property tax bills.

Several states are pursuing measures to limit the pain for homeowners by limiting annual increases to property tax revenue collections or assessment values.

In November, voters in Colorado and Georgia will weigh in on two such proposals. So far this year, Alabama, Wyoming, and Kansas have enacted new laws designed to limit future property tax hikes for homeowners. Other states are looking at more limited carve-outs and exemptions.

“All of these proposals are really about what’s the desired level of overall taxation and who has to pay it,” says Realtor.com® Chief Economist Danielle Hale. “Homeowners should remember, and many do remember, that you’re paying property taxes to fund local services, including things like schools, libraries, parks, and local facilities that can make a community a great place to live.”

The proposals follow a rapid surge in home values, which have jumped 54% in the past five years, according to the Case-Schiller home price index.

Last year, state and local governments collected about $760 billion in property taxes, a category that includes both real estate and personal property, according to U.S. Census data. That was up 31% from 2018, an increase that represents collections from new buildings as well as existing ones.

Property taxes are complex in part because they are usually assessed and collected at the local level in cities and counties, under rules that vary from state to state. Changing those rules, which are frequently already byzantine, can be a challenge for lawmakers, and has sometimes backfired in the past.

Washington state, which has capped annual increases to property tax revenues at 1% since 2001, is grappling with severe county-level budget woes as revenue fails to keep pace with rising costs to provide government services.

In 1982, voters in Georgia’s Muscogee County approved a local ordinance freezing property taxes for existing homeowners. As a result, longtime homeowners pay very little in property taxes compared with recent homebuyers.

Suzanne Widenhouse, the county’s chief appraiser, told the Associated Press last month that two similar homes worth about $330,000 had wildly different tax bills. One last sold in the 1980s owed just $8, while the other purchased five years ago owed $3,236.

Other states have faced trade-offs when pursuing targeted tax relief. Lower taxes on primary residences might mean rental and commercial properties carry a higher burden. And exemptions to provide relief for the elderly or veterans might result in higher taxes for everyone else.

“Ideally, you want property taxes to be low and apply generally, so that you don't distort decisions,” says Hale. “For example, you don't want people to feel like they have to stay in their home, because this particular home has a property tax protection, and if they move, they're going to lose that protection.”

Which states have property taxes on the ballot this year?

In November, voters in Colorado will decide whether to pass a state constitutional amendment that limits total statewide property tax revenue to 4% growth from the amount collected the prior year.

The measure, known as Initiative 50, would require the state to get voter approval through another ballot question to retain property tax revenue over the 4% growth cap.

Initiative 50 was sponsored by the Advance Colorado Institute, a conservative group that is also seeking certification for a second ballot question, Initiative 108, that would reduce assessment rates for both residential and nonresidential properties.

Getty Images

Colorado’s nonpartisan Legislative Council Staff estimates that Initiative 50 would decrease statewide tax revenue by about $115 million, while Initiative 108 would blow a $3 billion hole in local budgets in the first year alone.

If either measure passes, it would result in the repeal of bipartisan legislation passed earlier this year with the support of Democratic Gov. Jared Polis, which cuts residential assessment rates for the current property tax year and makes long-term changes to the property tax code.

Property taxes have long been a highly contentious issue in Colorado. However, residents of the Centennial State already pay among the lowest property taxes in the nation, with an effective tax rate of 0.55% for owner-occupied properties, according to the Tax Foundation.

Meanwhile, Georgia residents will vote on a measure that would allow assessments on residential property values to be capped at the rate of inflation.

Local governments would be able to opt out of implementing the cap after publicly announcing their intention to do so and holding public hearings on the decision.

“While this opt-out measure is included, it would be disappointing to see local governments utilize it,” said Georgia Lt. Gov. Burt Jones, a Republican, in a statement last month. “During record high inflation, skyrocketing debt, and expenses rising every day, local governments should be focused on bringing costs down—not letting them increase.”

Georgia has pursued a number of tax cuts this year, which the state can afford after running budget surpluses for several years. The state ended its last fiscal year with a $10.7 billion unallocated surplus.

Getty Images

Georgia residents are currently paying an effective property tax rate of 0.92% on owner-occupied homes, the median among the states, according to the Tax Foundation.

Several other states will vote on more limited ballot measures related to property taxes this year.

Voters in New Mexico will consider two ballot measures that would give greater property tax exemptions to veterans and disabled veterans, respectively.

In Arizona, a ballot measure would allow property owners to apply for a property tax refund if the local government fails to enforce nuisance ordinances, such as bans on public camping or panhandling.

And during Missouri’s primary election in August, a measure appearing on the ballot would exempt child care facilities from property taxes.

What states have new laws cutting property taxes?

A few states have passed new laws designed to limit future property tax increases this year.

Alabama enacted legislation that caps increases in assessed values on residential and commercial property to 7% of the assessed value from the prior year.

“This is a cap, not a tax cut,” state Sen. David Sessions, a Mobile Republican who sponsored the bill, told AL.com. “Recently in the last few years, inflation has been hitting real hard. Housing has been at a deficit, and property taxes are increasing substantially.”

In Wyoming, Republican Gov. Mark Gordon signed several bills designed to reduce property taxes.

One puts a 4% cap on year-to-year property tax increases on residential structures and land. Others provide exemptions for veterans and long-term homeowners over age 65.

“I am happy to sign this package of legislation, which provides targeted relief to taxpayers most impacted by increasing valuations, while ensuring our counties and schools are able to continue to provide the services our residents rely on,” Gordon said in March.

But Gordon vetoed a bill that would have provided a homeowner tax exemption of 25% of the fair market value of a primary residence, up to $200,000, calling the plan a “socialistic type of wealth transfer.”

Kansas also passed a bipartisan bill that increases the residential property tax exemption to $75,000, which Republican Gov. Laura Kelly says will save residential property owners $236 million over five years. Previously, the exemption was $40,000.

The bill was a compromise after legislators focused much of the comprehensive tax-cutting package on reducing income taxes, according to the Kansas City Star.

“We fully agree that not enough was done on property taxes,” said House Speaker Dan Hawkins, a Wichita Republican, after the special session last month to pass the bill.

Categories

Recent Posts